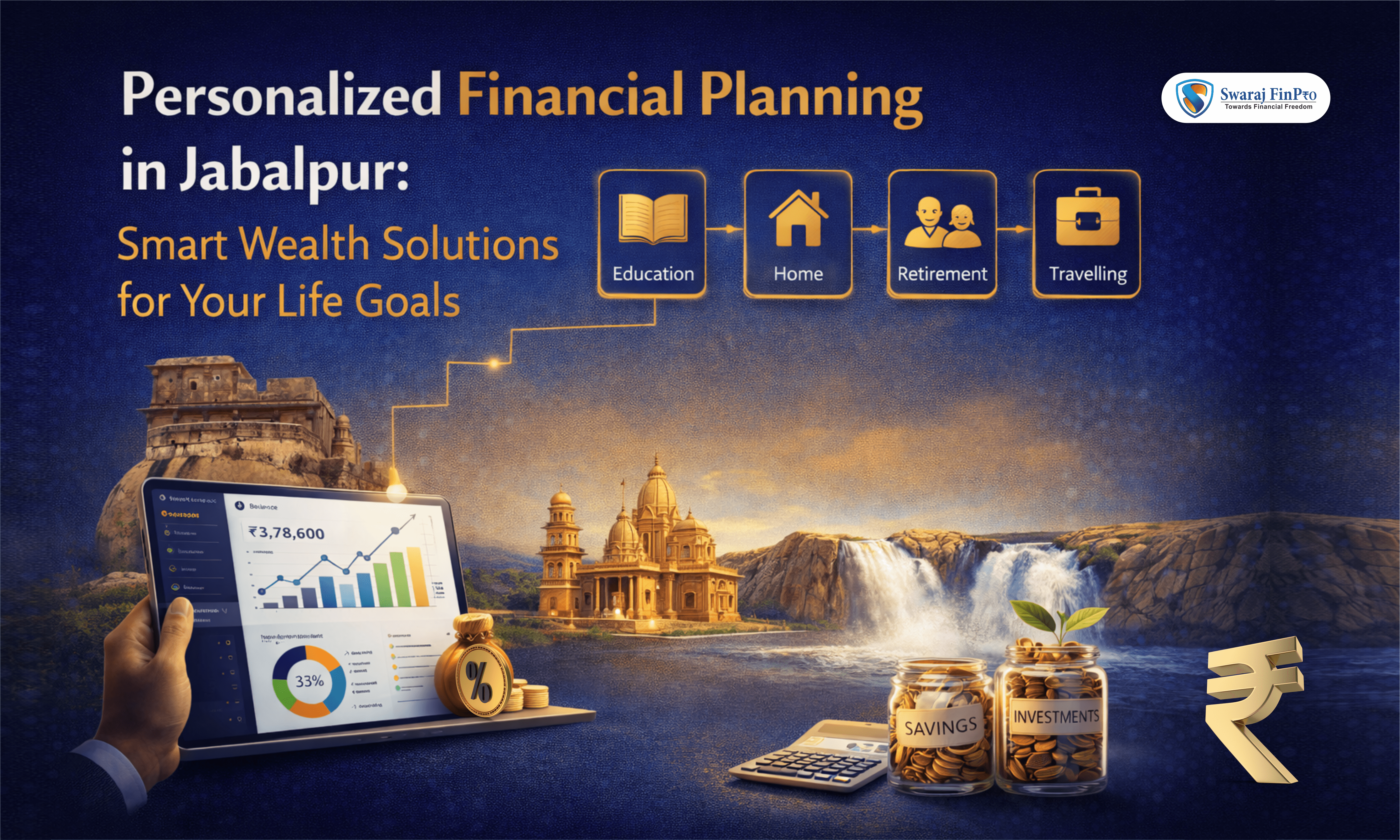

Personalized Financial Planning in Jabalpur: Smart Wealth Solutions for Your Life Goals

One City, Many Dreams — One Plan Doesn’t Fit All

Every family in Jabalpur has different dreams.

Some want to secure their child’s education.

Some aim for a stress-free retirement.

Some want to grow their business wealth safely.

Yet, most people still follow generic investment advice.

That’s where personalized financial planning makes a real difference.

In today’s uncertain economy, smart investors in Jabalpur are moving away from “one-size-fits-all” products and choosing customized wealth solutions aligned with their life goals.

What Is Personalized Financial Planning?

Personalized financial planning is a goal-based, customized approach where your investments are designed around:

- Your income & cash flow

- Your life goals (education, home, retirement, wealth creation )

- Your risk appetite

- Your time horizon

- Your family responsibilities

Instead of asking Which mutual fund is best?, the right question becomes:

What is the best plan for MY life?

Why Personalized Financial Planning Matters in Jabalpur

Jabalpur has a unique mix of:

- Salaried professionals

- Government employees

- Business owners

- Young earners starting early

- Families planning long-term stability

Each group faces different financial challenges.

Common local challenges include:

- Irregular income for business owners

- Dependence on traditional savings instruments

- Late start in retirement planning

- Over-reliance on tips from friends or social media

Personalized financial planning in Jabalpur helps overcome these challenges with clarity, discipline, and structure.

Key Life Goals That Need Smart Financial Planning

Child Education Planning

Education costs are rising faster than inflation.

A well-planned SIP strategy ensures your child’s future is secure without financial stress later.

Wealth Creation Through SIPs

Regular SIP investments help build long-term wealth using:

- Discipline

- Compounding

- Market volatility to your advantage

Retirement Planning

Retirement is not an age — it’s a financial number.A personalized retirement plan ensures:

- Monthly income post-retirement

- Protection from inflation

- Medical expense readiness

Business & Tax Planning

For business owners in Jabalpur, smart financial planning helps in:

- Managing surplus cash

- Tax efficiency

- Long-term capital growth

How Smart Wealth Solutions Work

Step 1: Financial Health Check

Understanding your:

- Income

- Expenses

- Assets

- Liabilities

Step 2: Goal Mapping

Short-term, medium-term, and long-term goals are clearly defined.

Step 3: Asset Allocation

Money is allocated across:

- Equity mutual funds (growth)

- Debt mutual funds (stability)

- Hybrid or multi-asset funds (balance)

- Liquid mutual funds (liquidity)

Step 4: Regular Review & Rebalancing

Markets change. Life changes.

Your plan should evolve, too.

Why Mutual Funds & SIPs Fit Personalized Planning

Mutual funds offer flexibility — making them ideal for goal-based planning.

- SIPs for disciplined investing

- Lump sum for surplus deployment

- Wider choice of risk levels

- Transparent & regulated structure

When aligned with personal goals, SIPs become wealth-building tools, not just monthly deductions.

Common Mistakes Investors Should Avoid

- Investing without clear goals

- Stopping SIPs during market volatility

- Copying others’ portfolios

- Ignoring regular reviews

- Relying only on fixed deposits

Smart investors plan. Average investors react.

Why Choose Expert Financial Guidance in Jabalpur

Online information is everywhere — personal advice is not. A local expert understands:

- Regional income patterns

- Local business cycles

- Real investor behavior

- Practical, not theoretical solutions

Personalized financial planning is not about selling products — It’s about building confidence, clarity, and control over money.

That’s Why Your Life Goals Deserve a Personal Plan

Your dreams are unique.

Your responsibilities are personal.

Your financial plan should be, too.

With personalized financial planning in Jabalpur, you can turn uncertainty into clarity and goals into achievable milestones.The earlier you plan, the easier wealth creation becomes.

Disclaimer : Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.