Investing 101: Essential rules to grow your money

Hi investors,

Today, let me take you back to the school days. During school time, we have learned many rules, be it academic or social.

You can’t solve math problems without learning the basic rules like the BODMAS, right?

Similarly, there are some investing thumb rules that you should follow to solve your investing problems and achieve success.

So, let’s get going.

20X Term Insurance Rule

Rather than investment, we should start with protection. You should get 20 times your annual salary as the life insurance cover. This is the minimum cover you should avail.

Let’s assume your salary is Rs. 12 lakhs/annum, you should get Rs. 2.4 crore cover.

The Power of Doubling (and Tripling): The rule of 72 and 114

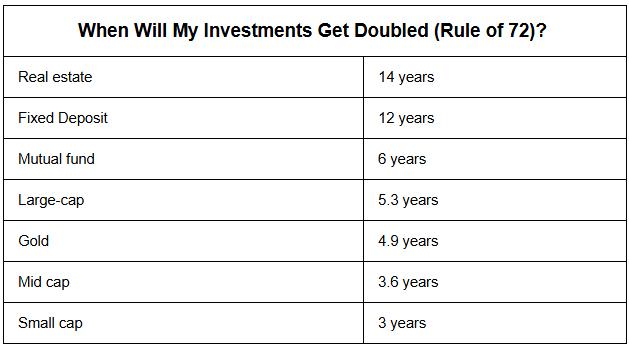

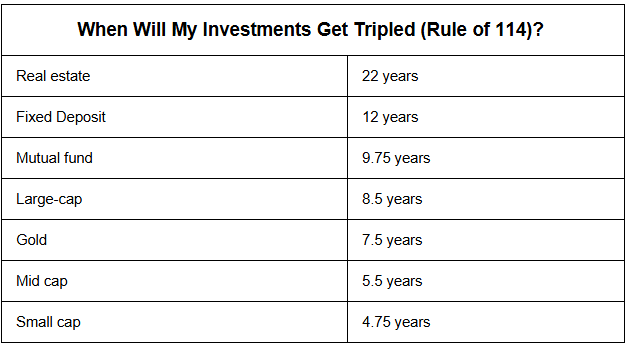

Ever wondered how long it takes to double your money?

The rule of 72 is a handy trick. Just divide 72 by your interest rate to get an idea.

Similarly, the rules of 114 and 144 help estimate how many years to triple or quadruple your money. Remember, higher interest rates mean your money grows faster.

Inflation: The Rule of 70

Inflation slowly eats away at your purchasing power. The rule of 70 can help you see this in action.

Divide 70 by the inflation rate to estimate how long it takes for your money's worth to be cut in half.

This highlights the importance of investing your money to grow it faster than inflation.

50/30/20 Rule of Budget

This rule suggests splitting your income into three buckets:

- 50% for essential needs like rent and groceries

- 30% for wants like that new gadget or vacation

- 20% for savings and investments

If 20% is a big commitment, start with 5%, and gradually aim for more whenever possible.

The First Week Rule

If you struggle with discipline to save and invest then, this rule will help you.

You should set aside 20% of your income for saving and investment in the first week after receiving your salary.

6X Emergency Rule

Life throws curveballs sometimes. That's why having an emergency fund is essential.

The 6X emergency rule suggests keeping at least 6 times your monthly income saved for unexpected expenses.

Ideally, aim for 12 times your monthly income for extra peace of mind.

The Net Worth Rule

Check this rule to know if you are wealthy or not. It states that multiply your gross income by your age and divide it by 10.

Example: If you are 30 years old with an income of Rs. 12 lakhs/annum, then your net worth should be at least Rs. 36 lakhs.

The 40% EMI Rule

Debt can be a useful tool, but managing it is key. The 40% EMI rule suggests limiting your monthly loan payments (EMIs) to a maximum of 40% of your income.

This helps you stay on top of your finances and avoid getting overwhelmed by debt.

The 25X Retirement Rule

You should aim to save at least 25 times your annual expenses for retirement.

Example: If your annual expenses are Rs. 10 lakhs, you should save Rs. 2.5 crore for retirement.

The 4% Withdrawal Rule

After building a retirement fund, how do you ensure it lasts even after your death?

Here is where the 4% Withdrawal rule applies. You should withdraw only 4% of your retirement corpus annually.

These investing thumb rules are like your cheat sheet to navigate the sometimes tricky world of finance. Remember, these are rules of thumb, so be sure to do your research and consult a mutual fund distributor for personalized guidance.

Think of it like this: mastering these basic rules is like learning your multiplication tables.

They might not solve every problem, but they give you a strong foundation to build on.

With some practice and knowledge, you'll be well on your way to becoming an investing champ, not a chump!